If you’re like a lot of aspiring homebuyers,

there’s a major hurdle standing in your way — the cost of living. From

groceries to gas, eggs, and just about everything else, prices have gone

up. And that rings true for home prices, too.

But even when

everything feels expensive, there are still ways to make homeownership

more than an item on your wish list. You may just need to think about

where you plan to buy a bit differently.

Think of Your First Home as a Stepping Stone

One

of the biggest misconceptions among buyers is that their first home has

to be their forever home – or that it has to check all the boxes of

what they want right out of the gate. In reality, it’s just a starting point.

Once you own a home, you start to build equity,

which grows over time as home prices rise. Down the road, if you want

to move — whether to a larger space, a better location, or both — the equity you’ve gained can help you do just that.

So

rather than waiting until you can afford your dream home in your ideal

neighborhood, consider starting with something that works for now.

Expand Your Search To Find More Affordable Options

If

high home prices in your favorite area are holding you back, it’s time

to cast a wider net. By keeping an open mind and being flexible with

location, you may be surprised at what’s possible within your budget.

Many buyers find success by looking in surrounding areas – and some even

choose to move out of state.

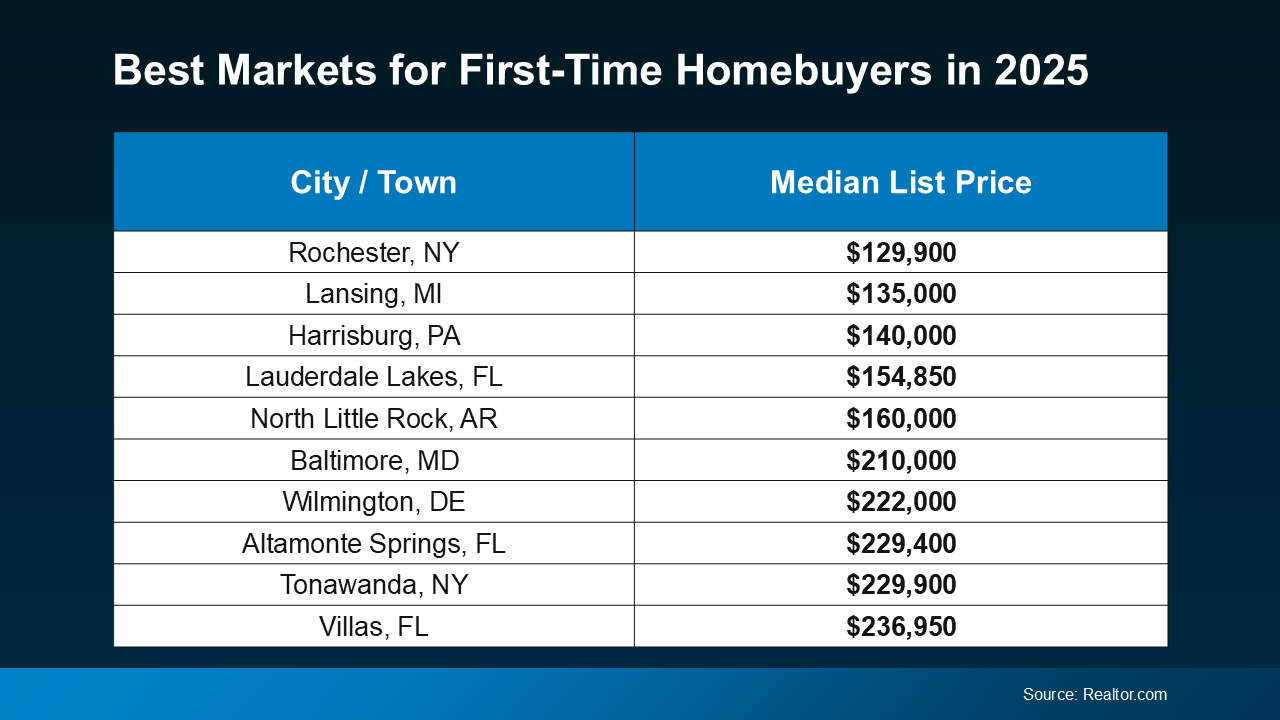

According to a report from Realtor.com, these are some of the best markets for first-time homebuyers this year (see chart below):

Of

course, moving to a different state isn’t for everyone – and isn’t a

necessity. The right agent can help you find more cost-effective options

wherever you are.

If you want to stay local, looking

just outside your preferred neighborhood could help you find something

you can afford that’s still pretty close to your favorite restaurants,

shops, and activities. Sometimes, moving as little as 10 minutes away

makes a big difference.

And the best way to see what’s available

is to work with a real estate agent who understands the local market and

can help you identify hidden gems nearby. An agent can point you to

communities you may not have considered that have lower price tags now

and are steadily gaining value and appeal. That way you can buy your

first home and be set up to gain equity through the years.

Bottom Line

Today’s

cost of living is a challenge for many homebuyers. But by exploring

different areas and working with a knowledgeable agent, you can take

that first step toward owning a home — and building equity for your

future.

How far outside of your area would you look to make homeownership happen? Let’s connect to chat through your options.

Sally Heldman

Broker Owner

Metro Brokers / Heldman Real Estate

303.475.4508 CELL

sally@sallyheldman.com